child tax credit 2021 portal

The credit was made fully refundable. The Child Tax Credit Update Portal allows families to update direct deposit information or unenroll.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

. Half of the money will come as six monthly payments and half as a 2021 tax credit. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17. Increased the credit from up to 2000 per qualifying child in 2020 to up to 3600 for each qualifying child under age 6.

When you file your 2021 tax return you can claim the other half of the total CTC. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. The expanded Child Tax Credit CTC for 2021 was a part of the American Rescue Plan Act ARPA signed into law by President Biden to get pandemic cash assistance to more families.

If you have a baby in 2021 your newborn will count toward the child tax credit payment of 3600. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children.

Children who are adopted can. Sales tax relief for sellers of meals. Here is some important information to understand about this years Child Tax Credit.

It also made the. 4 at 9 pm. Find COVID-19 Vaccine Locations With.

The deadline for the September payment has passed You can use the IRS. Increased the credit from up to 2000 per. The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit payment.

Sign in to your account. Youll need to print and mail the. Max refund is guaranteed and 100 accurate.

To be eligible for this rebate you must meet all of the following requirements. The next deadline to opt out of monthly payments is Oct. The IRS will make a one-time payment of 500.

An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. Get your advance payments total and number of qualifying children in your online account. Children who are adopted can also qualify if theyre US citizens.

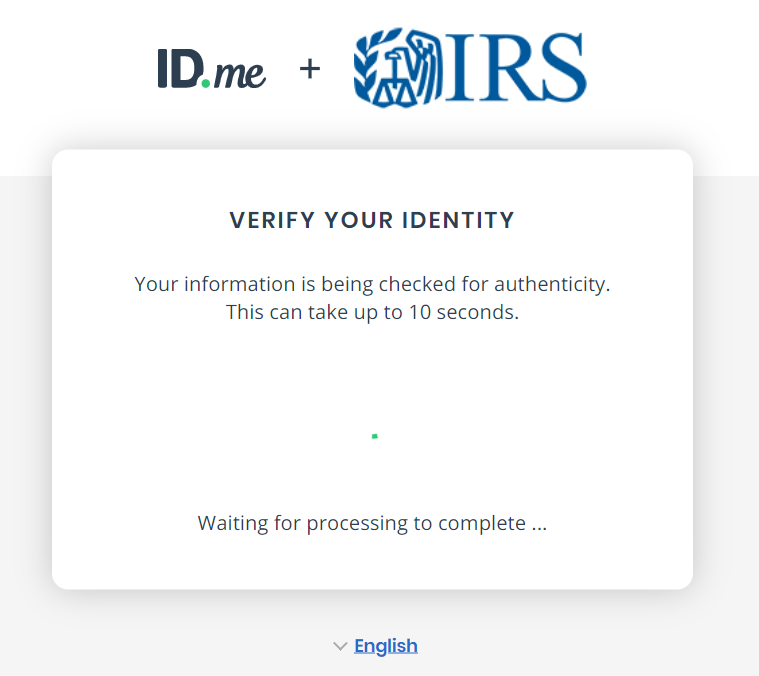

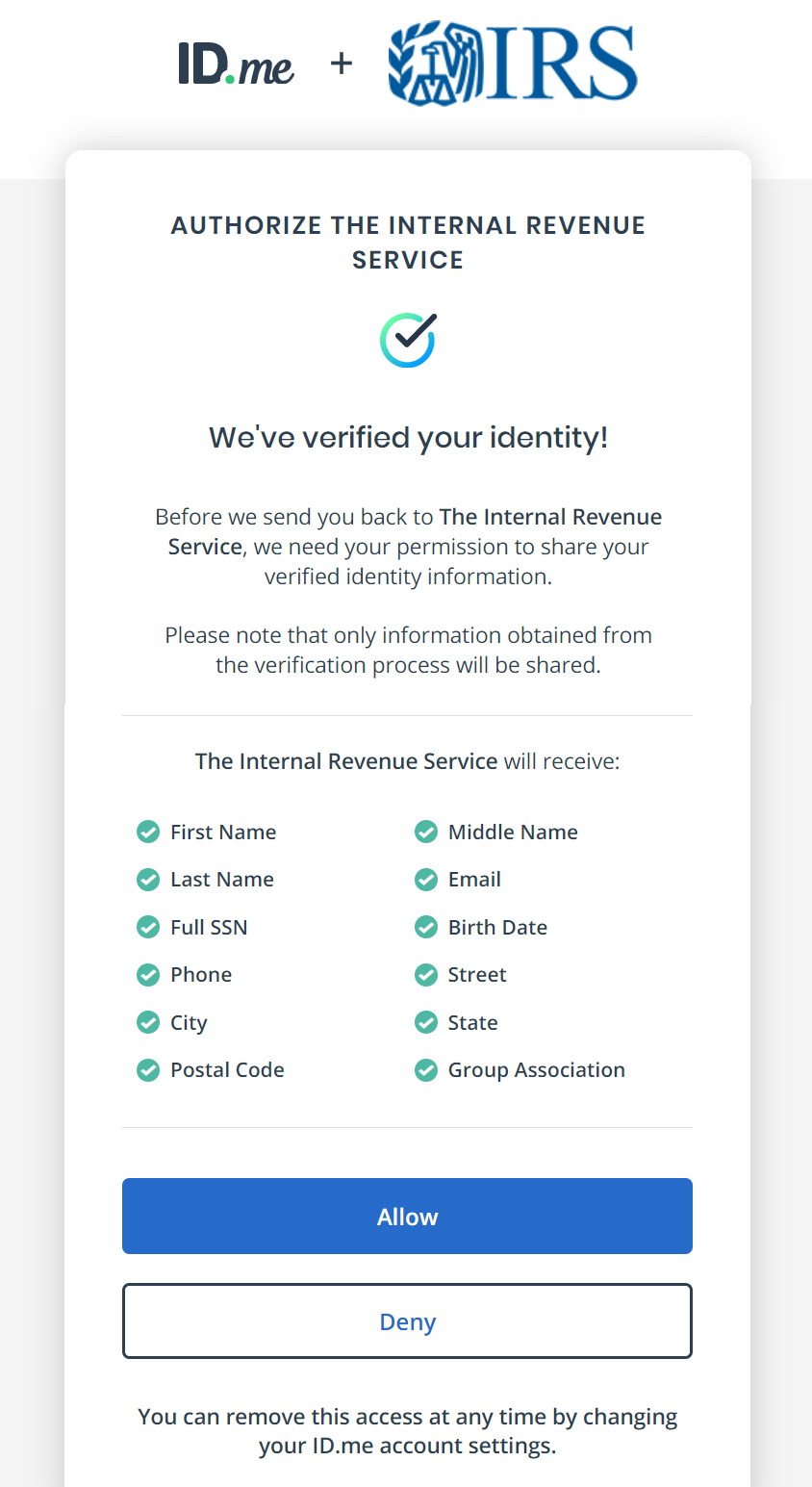

The Child Tax Credit Update Portal has been updated to allow families to update their direct deposit information or to unenroll from receiving advance payments for the child tax credit. COVID Tax Tip 2021-101 July 14 2021. Updates that have been made by August 2 nd 2021 will apply to the August 13 th payment as well as any.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. Specifically the Child Tax Credit was revised in the following ways for 2021. Taxpayers can access the Child Tax Credit Update Portal from IRSgov.

You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account. The IRS has confirmed that theyll soon allow claimants to adjust their. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit.

Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. Gas Tax - For updated information on the Suspension of the Motor Fuels Tax click here.

You must be a resident of Connecticut. The Department of Revenue Services to hold Live Virtual Event about the 2022 Child Tax Rebate on July 7 2022 Click here to learn more. That total changes to 3000 for each child ages six through 17.

You must have claimed at least one child as a dependent on your 2021 federal income tax return who was 18 years of age or younger. The American Rescue Plan Act. 2021 Tax Filing Information.

You can also refer to Letter 6419. The IRS will soon allow claimants to adjust their income and custodial. Child Tax Rebate - A new child tax rebate was recently authorized by the Connecticut General Assembly.

The credit amount was increased for 2021. Check mailed to a foreign address. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. The Child Tax Credit provides money to support American families. The IRS pre-paid half the total credit amount in monthly payments from July to December 2021.

The monthly payments started in July and ended in December with families receiving in cash up to half the credits total value of 3600 per child under 6 and 3000 per child ages 6 through 17. Change language content. Learn more about the Advance Child Tax Credit.

150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000. At first glance the steps to request a payment trace can look daunting.

Free means free and IRS e-file is included.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Gst Return Due Date List Jan 2020 Due Date Dating Date List

New Income Tax E Filing Portal To Be Launched From June 7 Existing Portal Will Be Unavailable From June 1 6 Online Taxes Digital Tax Income Tax

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Pin By The Taxtalk On Income Tax In 2021 Tax Refund Income Tax Chartered Accountant

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

Infosys Deadline To Fix Tax Filing Portal Is September 15 India S Tax Deadline Is 15 Days After Tax Deadline Filing Taxes Wealth Planning

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Al Naboodah Careers 2021 Group Jobs Across Uae New Openings Career Job Portal Secret To Success

How To Apply Gst Number In 2021 How To Apply Registration Legal Services

Easy Steps To Enroll Digital Signature Certificate On New Tax 2 0 Portal Government Portal Tax Software Digital Signature

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet