rank real estate asset classes by risk

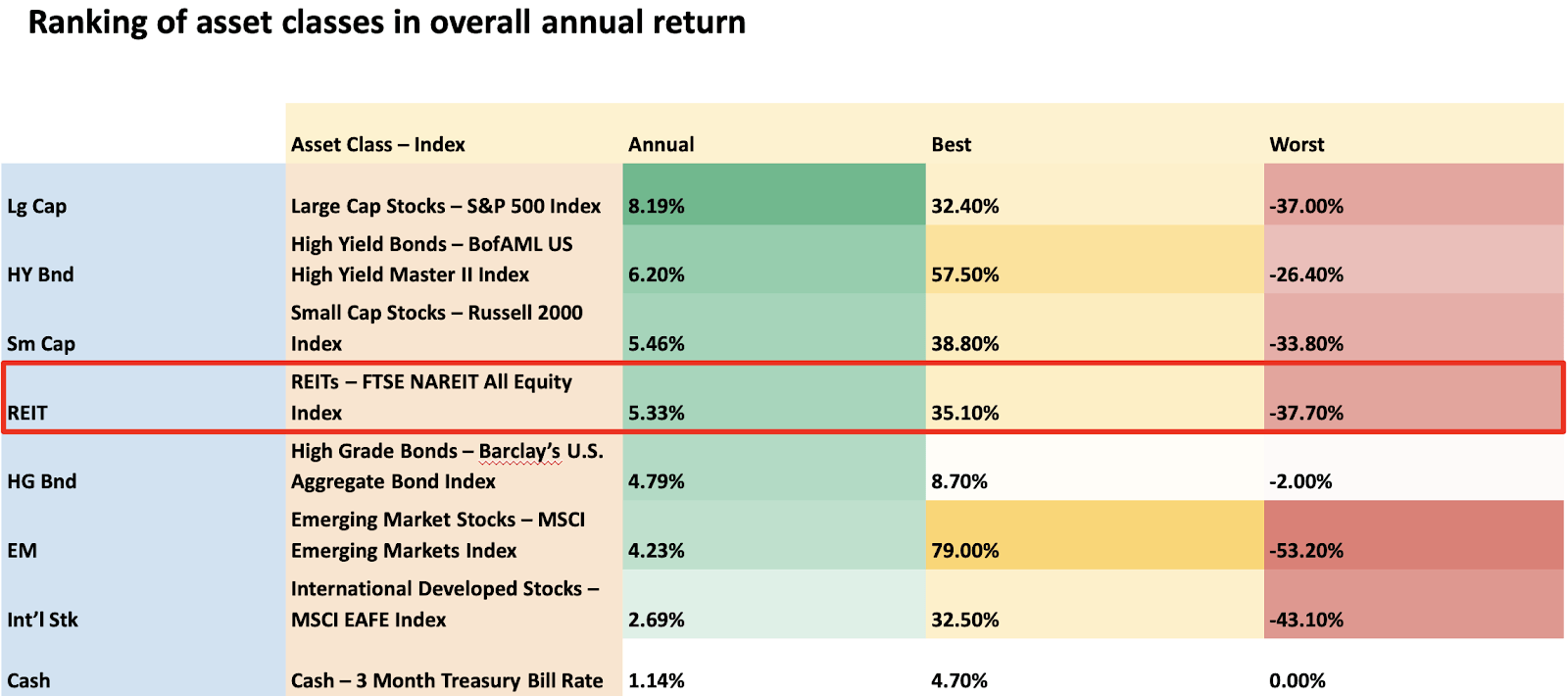

Below is the risk and return for select asset classes from 2010-2019 organized from lowest return to highest return. Ian Formigle Posted April 20 2016.

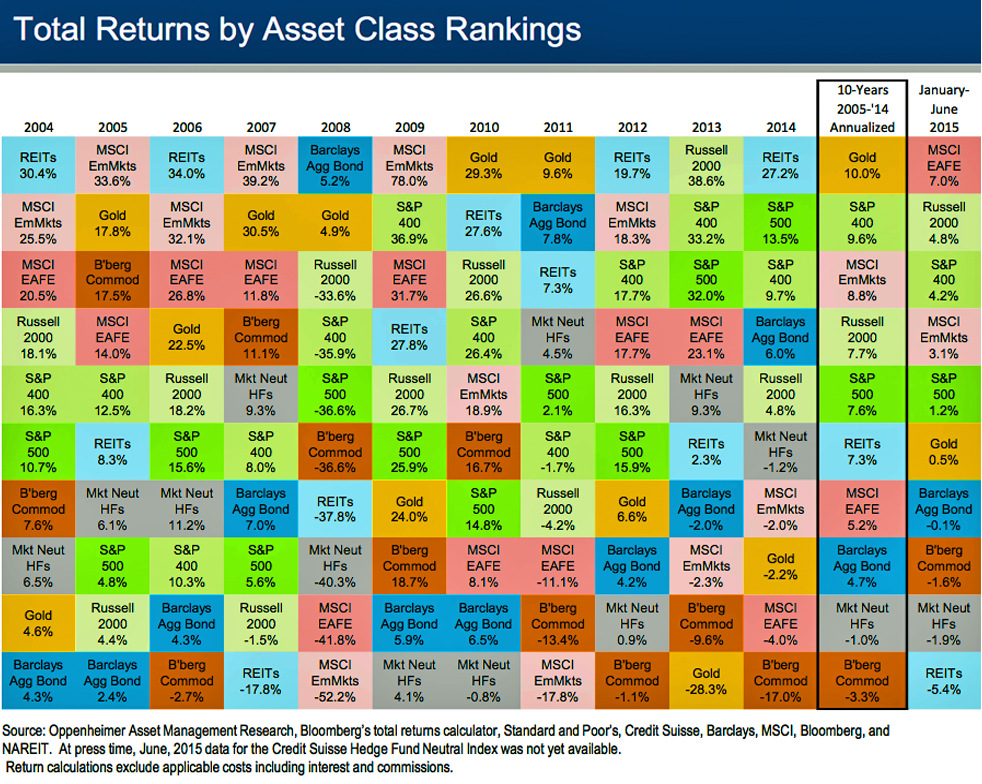

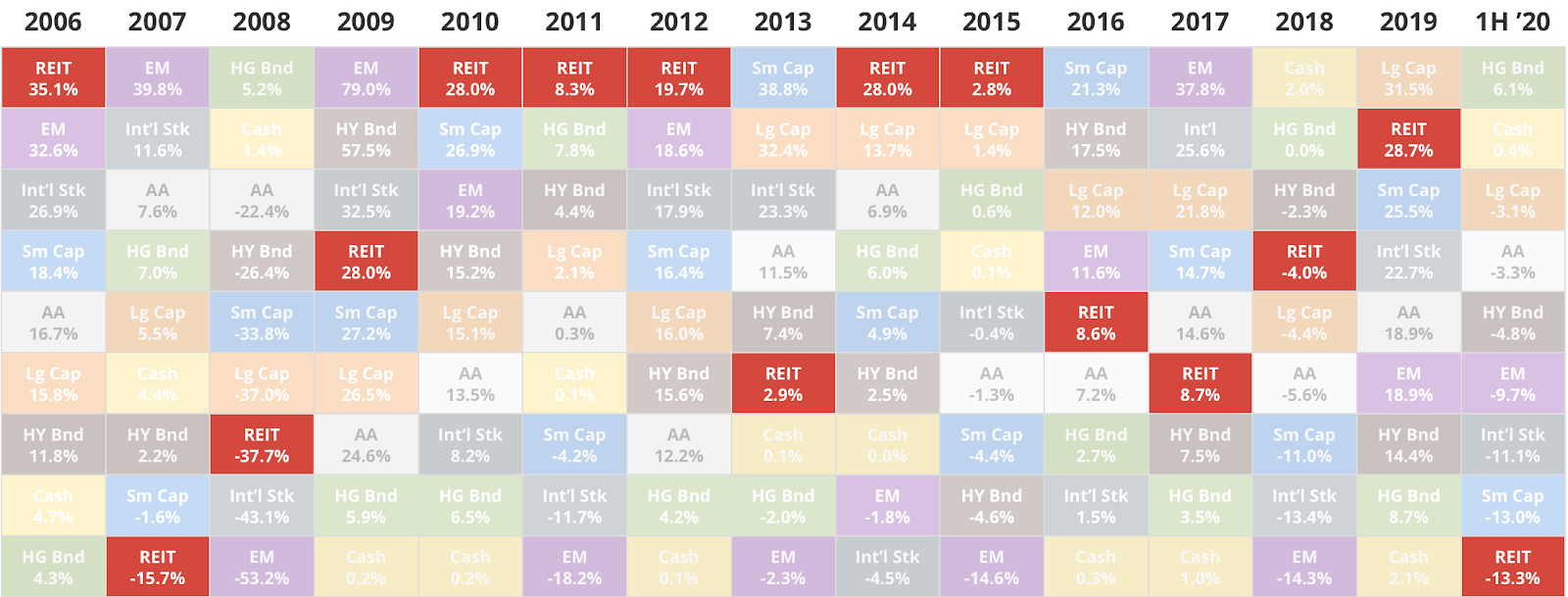

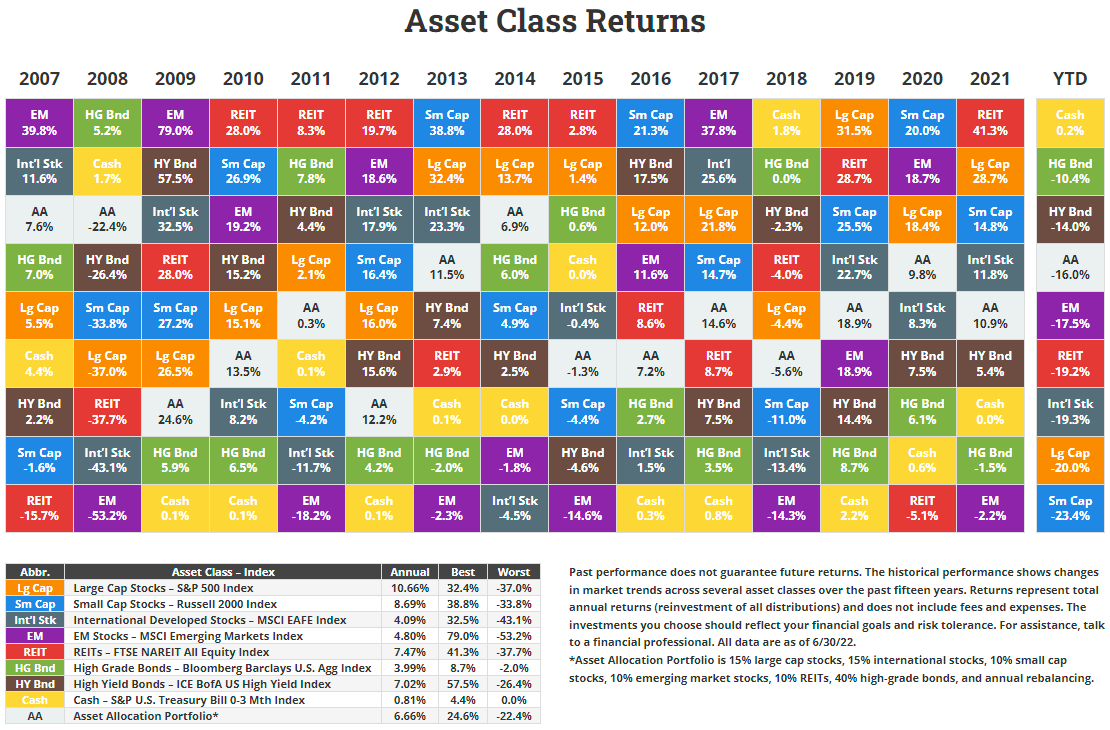

Chart The Historical Returns By Asset Class Over The Last Decade

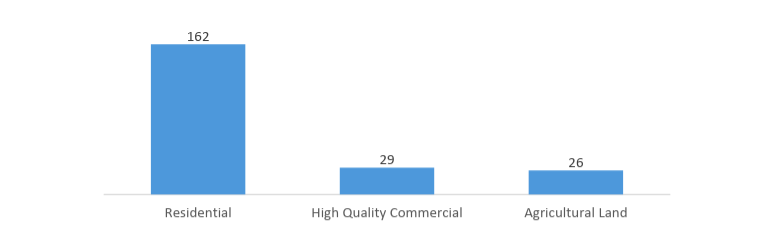

However the most common types of asset classes to invest in are.

. Real estate is a well-known asset class that has been used to build wealth for centuries defend against inflation and is sometimes referred to as recession-resistant. The commercial real estate market is divided into six primary asset classes. Apply to Head of Marketing Head of Operations Asset Manager and more.

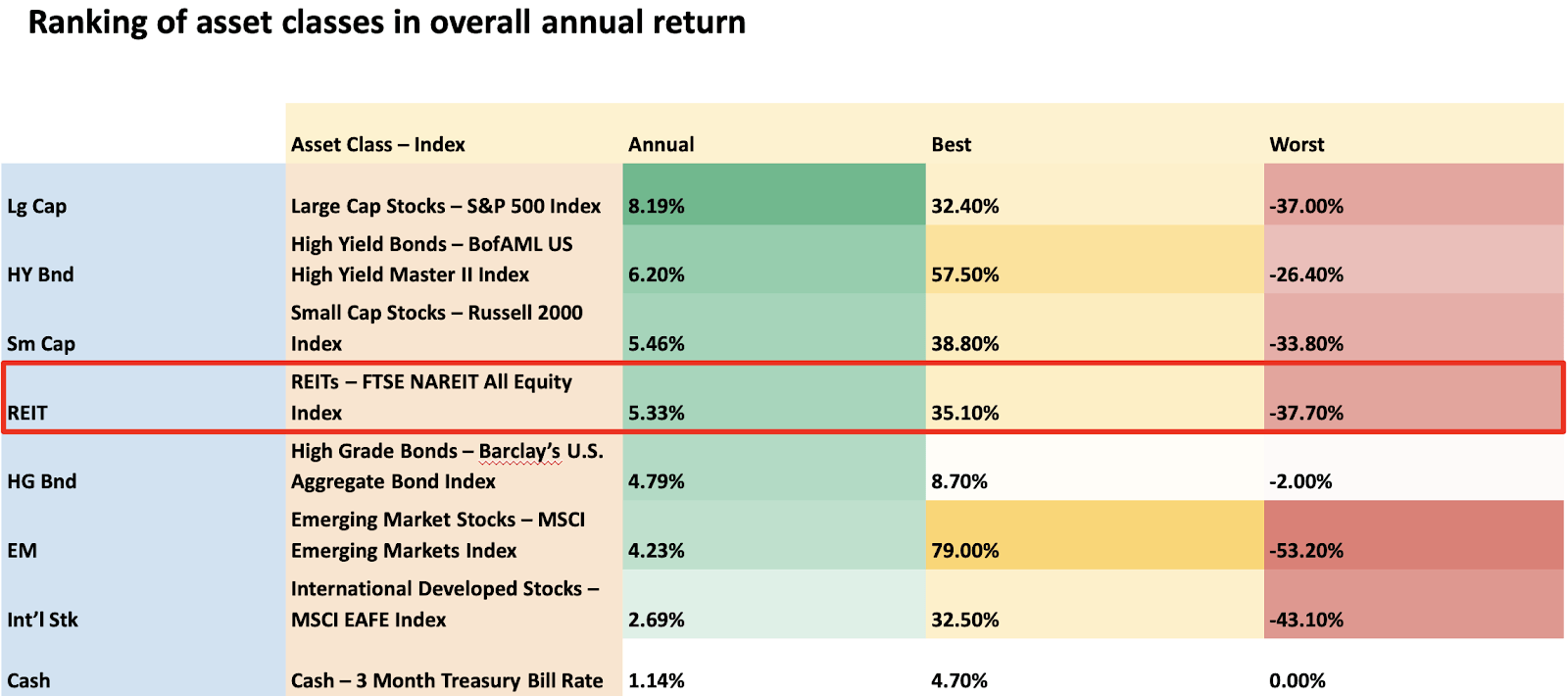

The second highest median return goes to the Mortgage sector which earns income. Property class refers to the quality and functionality of the property. On the other hand real estate investment trusts REITs.

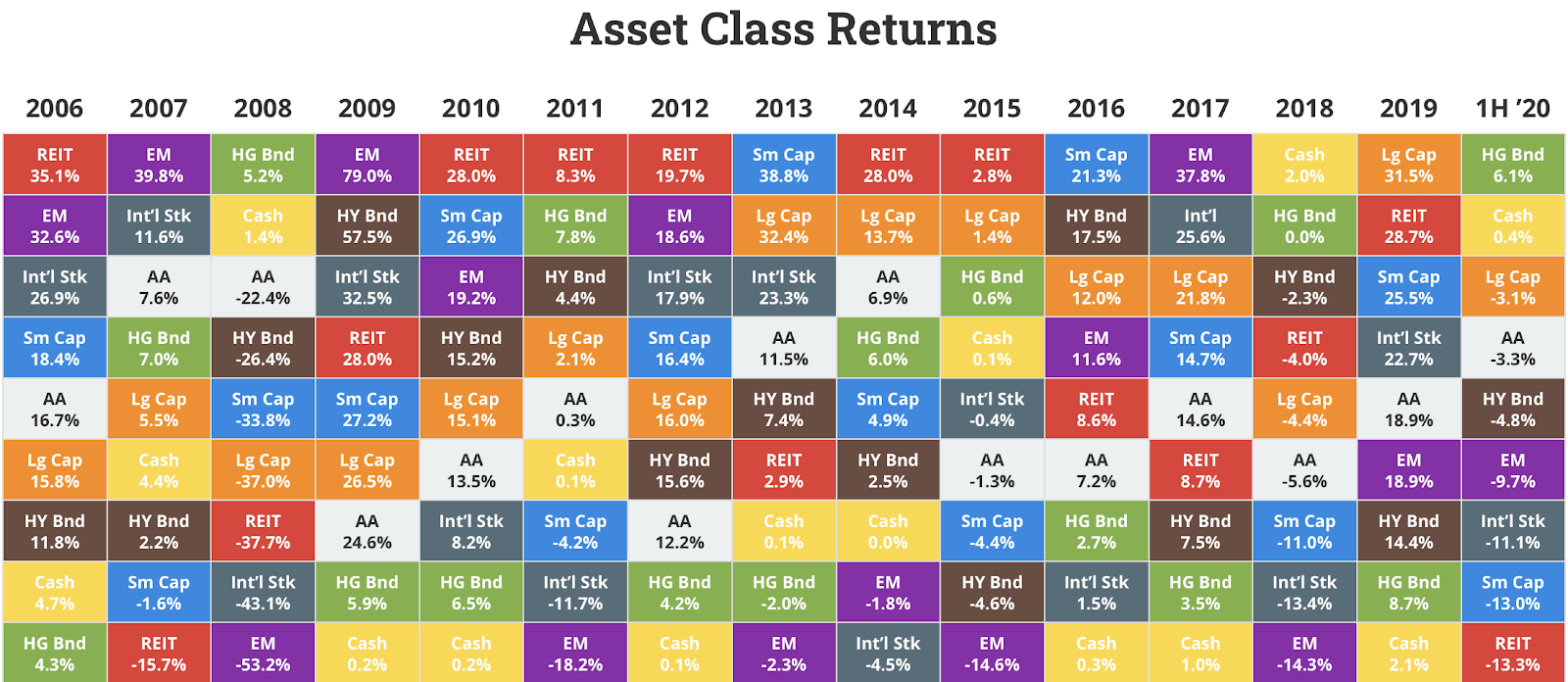

Several CalPERS asset classes have emerging manager definitions based on assets under management andor length of track record. Dividends aside they offer no guarantees and investors money is subject to the successes and failures of private. The top-performing asset class so far in 2020 is gold.

Residential office industrial retail and hospitality. See the bottom of the graphic for the specific. An asset class is best described as a grouping of investments or financial vehicles that all maintain somewhat similar characteristics.

The top-performing asset class so far in 2020 is gold with a return more than four times that of second-place US. Most will rank them on a general scale from Class A to Class C with others going as far as from Class A to Class F. Im mainly looking at.

Industrials have seen the highest median return and their risk is about middle of the pack. Savings Bonds and US. Sign up for a free account today to access our live commercial real estate funds.

The next best performers were US. Including lower subcategories of each class such as A- B-. Treasury bills are the safest options but they also offer the least in terms of profits.

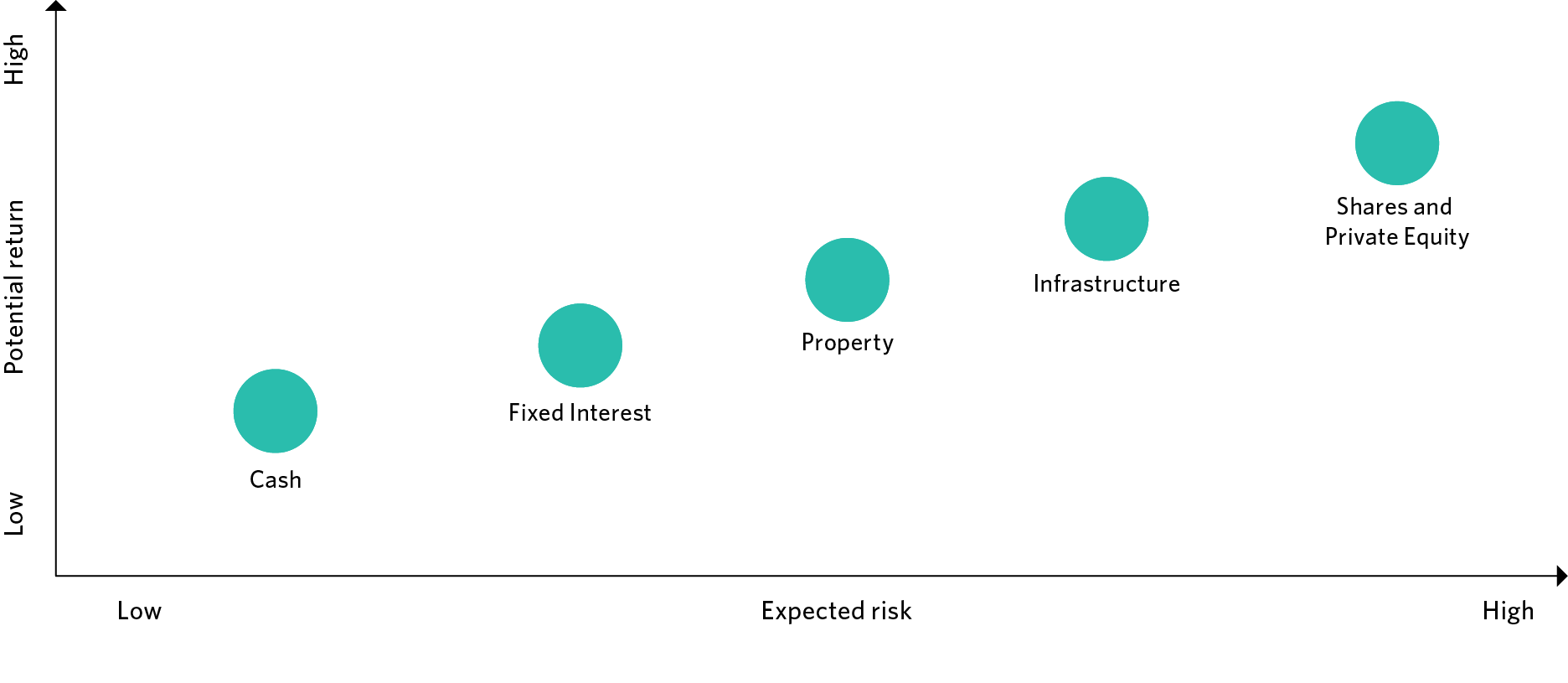

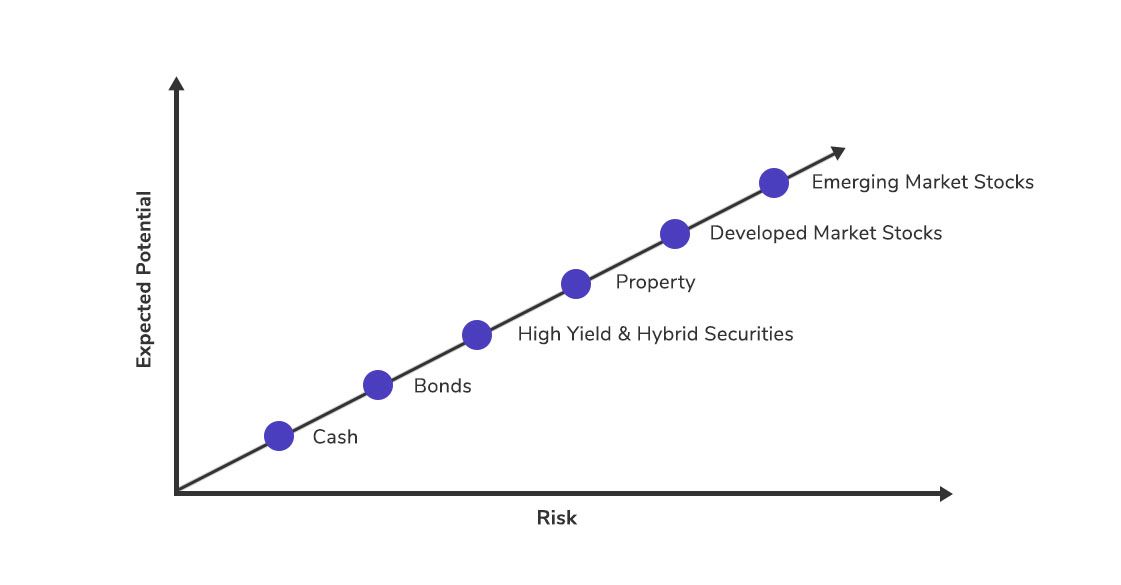

Within each asset class properties will be. Here are the types of asset classes ranging from high risk with high return to low risk with low return. Dear all Im having trouble to find arguments when ranking real estate asset classes in terms of risk.

Asset classes refer to a group of securities with comparable features and responses to market variations. Within private equity real estate assets are typically grouped into four primary strategy categories based on investment strategy and. As described above the property asset class is focused on the use of the property.

Emerging Manager programs are. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of this information before making any decisions based on such. Become Real Estate Investor - Learning Real Estate Investing Quick Free Updated 2022.

Real estate has the highest risk and the highest potential return. For investors to take on higher risks they would need to be adequately compensated for the additional risks that they bear. Ranking The Historical Returns of Asset Classes.

Ad Real Estate Investing Guide - Real Estate Investing - Real Estate Investing Tutorial 2022. Generally CDs savings accounts cash US. Ad Learn More About American Funds Objective-Based Approach to Investing.

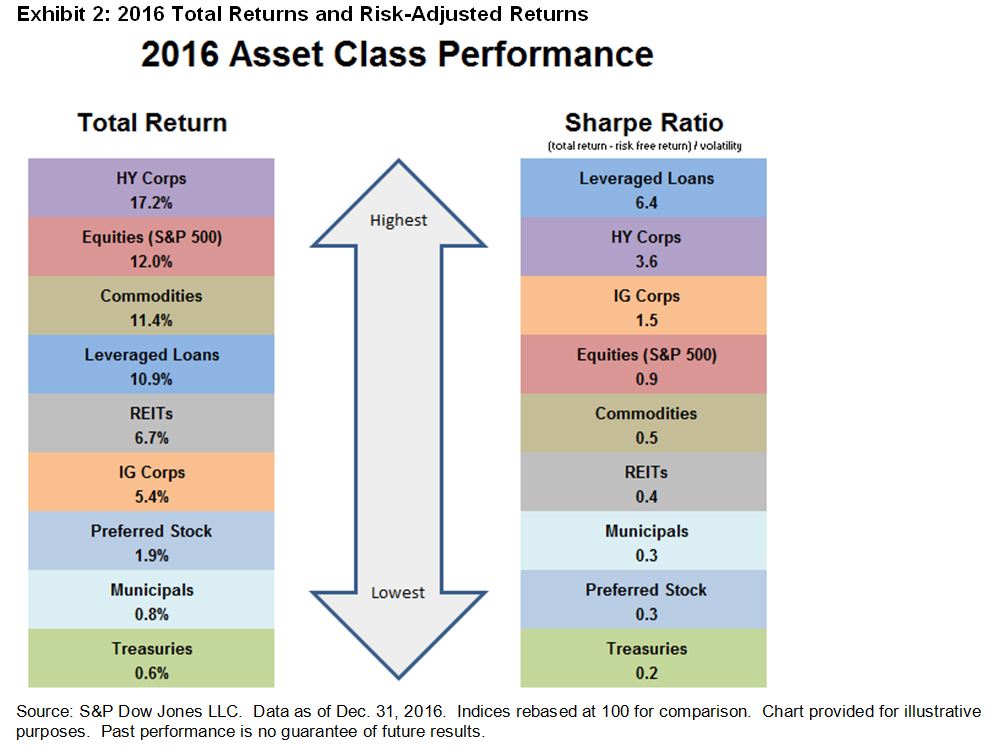

Equities are generally considered the riskiest class of assets. Ad Invest in diverse asset classes from multifamily industrial retail more on CrowdStreet. In January of 2019 and 2020 I published year-in-review posts on the returns performance of various asset classes.

Apply to Head of Marketing Asset Manager Real Estate Associate and more. The Californian Collection Laws are statutes that provide the legal rights and powers that a creditor has to enforce a judgment against a debtor. It aids the investors in deciding the proper investment strategies and receiving.

Large-cap growth stocks were the best performer of any asset class with a remarkable total annual return of 40. The first asset class is real estate. Real estate has the highest risk and the highest.

-Multifamily -Retail -Office -Student living -Light. For example in 2020 US. Cash and cash equivalents Equity Fixed-income securities Real estate Commodities Derivatives Currencies.

See How American Funds Can Help Improve Client Outcomes Through Objective-Based Investing. In commercial real estate this gets defined as Class A. 1 2 Corporate.

Thus theyll typically behave fairly similarly. As an asset class real estate investments.

The Monolith And The Markets Short Message Service Johnson And Johnson World

Year In Review 2016 Asset Class Performance Seeking Alpha

Investing In The Art Market A 1 7 Trillion Asset Class Portfolio For The Future Caia

Reits Is The Most Consistent Asset Class Providing The Best Return Over The Past 15 Years Seeking Alpha

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

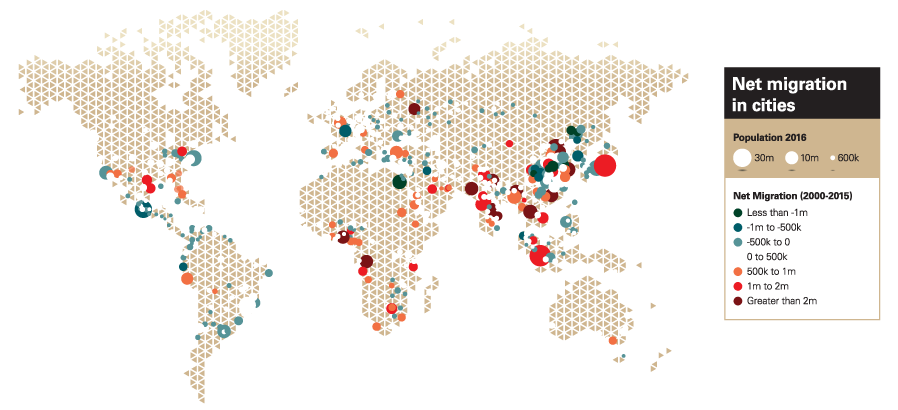

How Housing Became The World S Biggest Asset Class The Economist

Asset Classes Explained Understanding Investments Unisuper

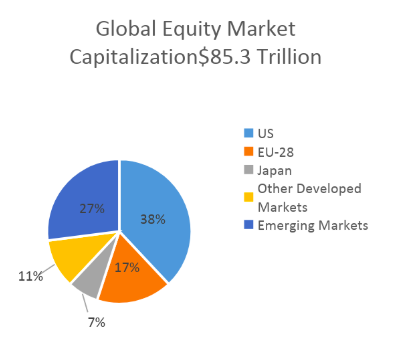

Part Ii On Asset Classes Size Of Markets And Trading Volumes By Les Nemethy And Sergey Glekov Europhoenix

The Real Estate Risk Reward Spectrum Investment Strategies

Part Ii On Asset Classes Size Of Markets And Trading Volumes By Les Nemethy And Sergey Glekov Europhoenix

Reits Is The Most Consistent Asset Class Providing The Best Return Over The Past 15 Years Seeking Alpha

Reits Is The Most Consistent Asset Class Providing The Best Return Over The Past 15 Years Seeking Alpha

Annual Asset Class Returns Novel Investor

Part Ii On Asset Classes Size Of Markets And Trading Volumes By Les Nemethy And Sergey Glekov Europhoenix

Meyer Asset Management Ltd Tokyo Types Of Investment Funds Infographic Investing Finance Investing Mutual Funds Investing

Risk Versus Average Return Of Asset Classes Finance Perso

Rising Potential Of The World S Largest Asset Class Hsbc Liquid

Zerodha Founder Shares Which Asset Class Gave Highest Returns In Last 10 Years Mint