san francisco county sales tax rate

Puerto Rico has a 105 sales tax and San Francisco County collects an additional 025 so the minimum sales tax rate in San Francisco County is 625 not including any city or special district taxes. This is the total of state county and city sales tax rates.

California Taxpayers Association California Tax Facts

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller.

. In San Francisco the tax rate will rise from 85 to 8625. 3 rows San Francisco County CA Sales Tax Rate. L Local Sales Tax Rate.

Most of these tax changes were approved by voters in the November 2020 election the California Department of Tax and Fee Administration said. San Francisco County CA Sales Tax Rate. The South San Francisco California sales tax is 750 the same as the California state sales tax.

The minimum combined 2022 sales tax rate for San Francisco California is. The current total local sales tax rate in San Francisco CA is 8500. California City and County Sales and Use Tax Rates Rates Effective 04012017 through 06302017 3 P a g e Note.

Get Results On Find Info. Presidio San Francisco 8625. While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected.

San Joaquin County CA Sales Tax Rate. San Francisco CA Sales Tax Rate. The current total local sales tax rate in San.

What Is The Tax Rate In San Francisco. The County sales tax rate is. Some areas may have more than one district tax in effect.

The California state sales tax rate is currently. San Diego County CA Sales Tax Rate. The California sales tax rate is currently 6.

4 rows The current total local sales tax rate in San Francisco CA is 8625. The minimum combined sales tax rate for San Francisco California is 85. S California State Sales Tax Rate 75 c County Sales Tax Rate.

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. You can calculate Sales Tax manually using the formula or use the San Francisco County Sales Tax Calculator or compare Sales Tax between different locations within California using the California State Sales Tax Comparison Calculator. Argus 7750 San Bernardino Arleta Los Angeles 9500 Los Angeles Arlington Riverside 8750 Riverside Armona 7250 Kings Army Terminal 9250 Alameda Arnold 7250 Calaveras Aromas 7750 Monterey Arrowbear Lake 7750 San Bernardino Arrowhead Highlands 7750 San Bernardino Arroyo Grande 7750 San Luis Obispo.

Those district tax rates range from 010 to 100. SAN FRANCISCO COUNTY 8625 SAN JOAQUIN COUNTY 775 City of Lathrop 875 City of Lodi 825 City of Manteca 825 City of Stockton 900 City of Tracy 825 SAN LUIS OBISPO COUNTY 725 City of Arroyo Grande 775 City of Atascadero 875 City of Grover Beach 875 City of Morro Bay 875 City of Paso Robles 875 City of Pismo Beach 775. San Mateo County CA Sales Tax Rate.

Santa Clara County CA Sales Tax Rate. There is no applicable city tax. The San Francisco California sales tax rate of 8625 applies to the following 29 zip.

How much is sales tax in San Francisco. The minimum combined 2022 sales tax rate for San Francisco County California is. Sr Special Sales Tax Rate.

The South San Francisco Sales Tax is collected by the merchant on all qualifying sales made within South San Francisco. This is the total of state and county sales tax rates. Search San Francisco Sales Tax Rate.

The County sales tax rate is 025. The statewide tax rate is 725. This is the total of state county and city sales tax rates.

The statewide tax rate is 725. What is Bay Area sales tax. What is CA sales tax.

The total sales tax rate in any given location can be broken down into state county city and special district rates. The South San Francisco California sales tax is 925 consisting of 600 California state sales tax and 325 South San Francisco local sales taxesThe local sales tax consists of a 025 county sales tax a 050 city sales tax and a 250 special district sales tax used to fund transportation districts local attractions etc. Next to city indicates incorporated city City Rate County Blossom Valley 9000 Santa Clara Blue Jay 7750.

The current total local sales tax rate in South San Francisco CA is 9875. Presidio of Monterey Monterey 9250. The Sales and Use tax is rising across California including in San Francisco County.

850 Is this data incorrect The San Francisco County California sales tax is 850. The California sales tax rate is currently. The San Francisco County sales tax rate is.

Those district tax rates range from 010 to 100. The San Francisco sales tax rate is. Santa Cruz County CA.

The December 2020 total local sales tax rate was 9750. The December 2020. The San Francisco County sales tax rate is.

Santa Barbara County CA Sales Tax Rate. San Francisco tax rate. Ad Search San Francisco Sales Tax Rate.

Solution found The 85 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 225 Special tax. The 2018 United States Supreme Court decision in. The total sales tax rate in any given location can be broken down into state county city.

San Luis Obispo County CA Sales Tax Rate. This table shows the.

Understanding California S Property Taxes

Sales Gas Taxes Increasing In The Bay Area And California

California City County Sales Use Tax Rates

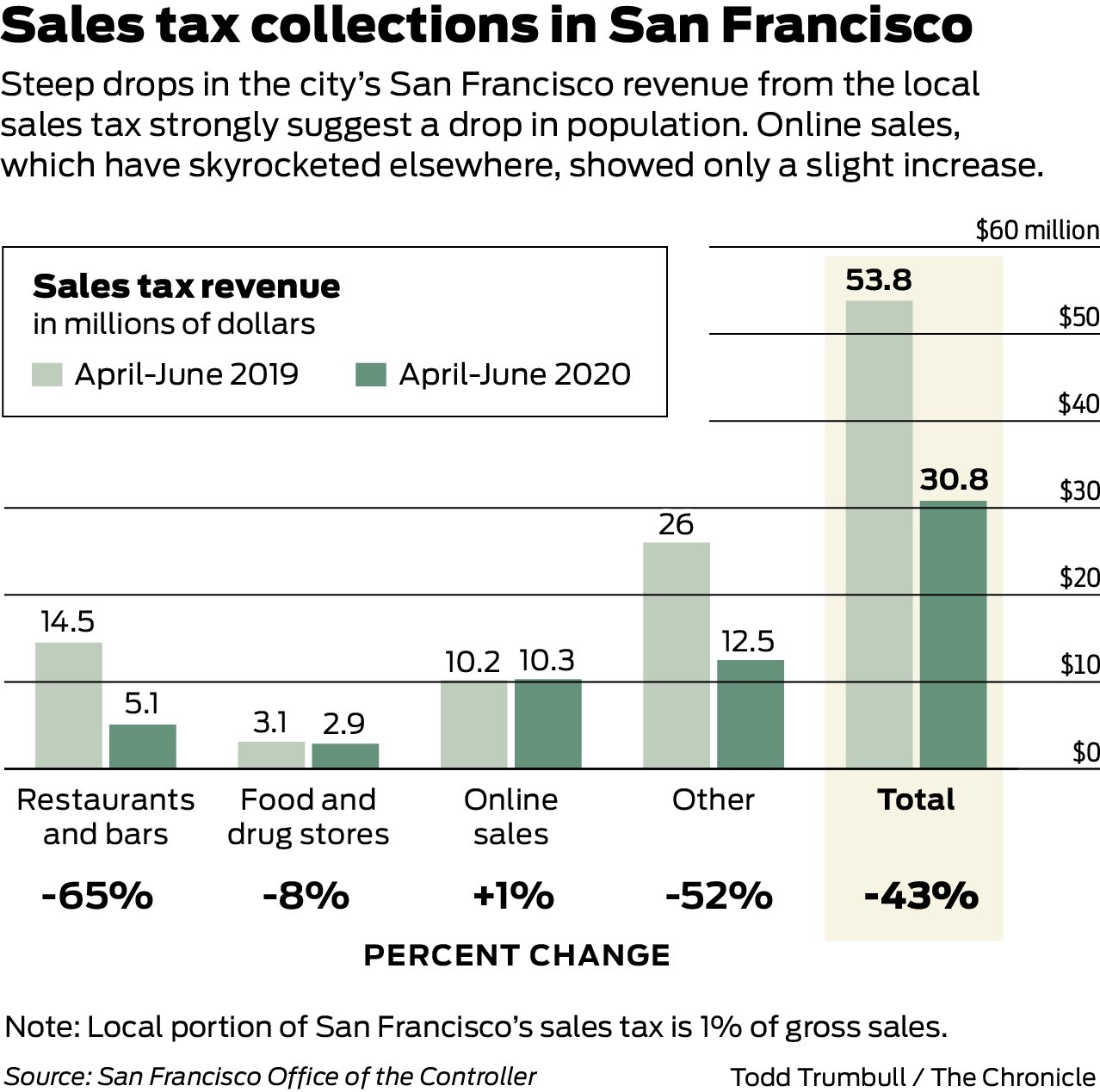

Yes People Are Leaving San Francisco After Decades Of Growth Is The City On The Decline

All About California Sales Tax Smartasset

Transfer Tax In Marin County California Who Pays What

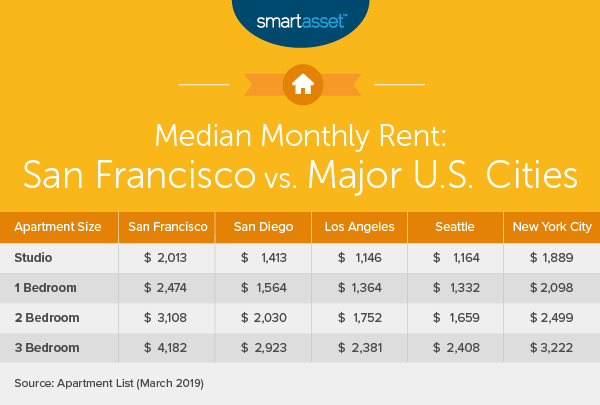

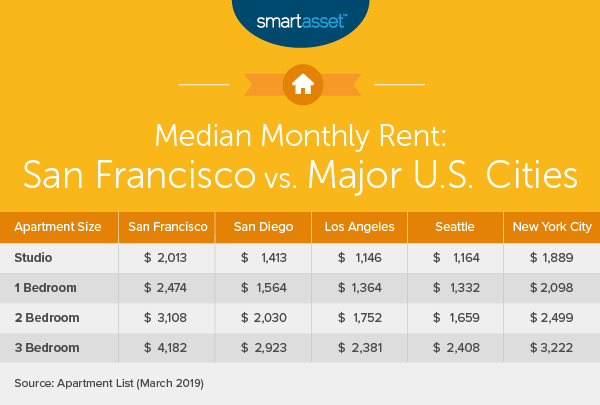

What Is The True Cost Of Living In San Francisco Smartasset

Understanding Where California S Marijuana Tax Money Goes

How Do State And Local Sales Taxes Work Tax Policy Center

/buying-vs-renting-san-francisco-bay-area-ADD-V2-d0efaf2b7ac346bbba2c1ac389751ef1.jpg)

Buying Vs Renting In San Francisco What S The Difference

What You Should Know About Santa Clara County Transfer Tax

Understanding California S Sales Tax

California Sales Tax Small Business Guide Truic

How Do State And Local Sales Taxes Work Tax Policy Center

Understanding California S Property Taxes

California Sales Tax Rates By City County 2022